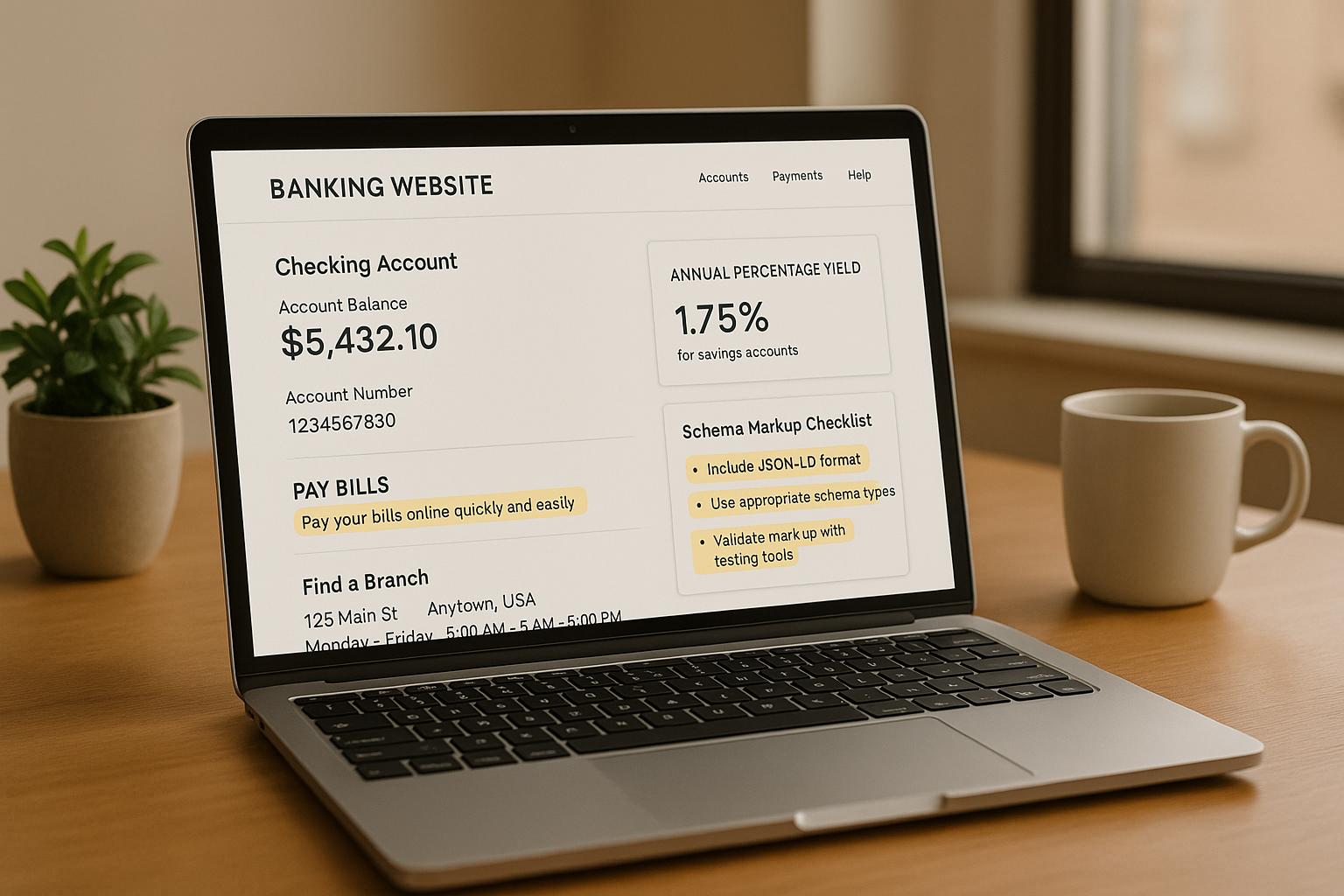

Schema markup helps online banking platforms improve search visibility and user experience by enabling rich search result features. By clearly labeling website content with structured data, banks can ensure search engines display accurate information about their services, branch locations, and financial products. This guide outlines the essential schema types and steps to implement them effectively.

Key Schema Types for Banks:

- Organization Schema: Defines your bank’s brand and contact details for search engines.

- LocalBusiness Schema: Highlights branch-specific details like hours, address, and phone numbers.

- FinancialProduct Schema: Displays details for services like loans, credit cards, and savings accounts.

- FAQPage Schema: Answers common customer questions directly in search results.

- Breadcrumb Schema: Improves site navigation by showing page hierarchy in search results.

Implementation Steps:

- Audit Website Content: Map pages to appropriate schema types.

- Use JSON-LD Format: The preferred format for structured data.

- Validate Markup: Test using tools like Google’s Rich Results Test.

- Maintain Updates: Regularly review and update schema to reflect changes in services or branch details.

Properly applied schema markup ensures your banking website stands out in search results, attracts qualified traffic, and provides clear information to potential customers.

Schema Markup: A Step-By-Step Guide

Required Schema Types for Online Banking Platforms

Using the right schema types can dramatically improve how search engines display your banking website, giving your institution a real edge in a competitive market.

Organization Schema

Organization schema acts as the digital backbone of your bank’s online presence. It defines your institution as a financial entity, ensuring search engines present accurate and consistent brand information in search results and knowledge panels.

Key details to include are your bank’s name, official website URL, logo, main address, primary phone number, and any social media profiles using the sameAs property. The contactPoint property also lets you provide contact details for specific departments like customer service, technical support, or loan inquiries. With this markup, your bank can appear in Google’s knowledge graph, offering a trustworthy snapshot of key details directly in search results.

For branch-specific visibility, you’ll need to integrate LocalBusiness schema.

LocalBusiness Schema

If your bank operates physical branches, LocalBusiness schema is a must. With 46% of Google searches focused on local intent, this markup ensures your branches show up prominently in local search results and on Google Maps.

You can use LocalBusiness schema to provide complete details about each branch, including address, hours, and contact information. Use hierarchical properties like parentOrganization or branchOf to link branches to your main Organization schema. The FinancialService subtype identifies your location as a financial institution, while properties like priceRange, currenciesAccepted, and paymentAccepted help customers understand what to expect before visiting.

It’s important to note that LocalBusiness schema applies only to publicly accessible locations with physical addresses. Online-only banks should stick to Organization schema instead.

Once your location data is covered, it’s time to showcase your banking products with Product schema.

Product Schema for Banking Services

Product schema is ideal for highlighting your banking services directly in search results, making it easier for customers to compare offerings without needing to visit multiple websites. This schema works especially well for services like credit cards, loans, savings accounts, and investment products.

Include essential details such as the product name, a detailed description, your bank’s brand, and pricing or offer information. Use the offers property to specify price currency (e.g., USD for U.S. banks), interest rates, fees, and availability. Adding aggregateRating with customer reviews can further enhance trust by displaying social proof.

For example, a credit card might display its annual fee, rewards rate, and average customer rating right in the search snippet. Mortgage products could include current interest rates and qualification criteria. This level of transparency not only attracts qualified leads but also reduces irrelevant inquiries.

Focus on one product per page for clarity and better search result displays.

FAQPage and Review Schema

FAQPage schema allows you to display frequently asked questions directly in search results, making it easier for users to find answers quickly.

Each FAQ should include the full question in the name field and the complete answer in the acceptedAnswer property. You can use HTML formatting for links, paragraphs, or lists, but all content must be visible on your webpage – even if it’s behind expandable sections.

Typical banking FAQs might address topics like opening accounts, fee structures, security protocols, or service availability. Complement this with Review schema to showcase customer feedback and aggregate ratings, which help establish trust – particularly vital in the financial sector.

Breadcrumb Schema

Breadcrumb schema improves navigation across your banking website by showing the site hierarchy directly in search results. This is especially helpful for banks offering a wide range of services, such as personal banking, business accounts, loans, and investment options.

The markup requires a series of ListItem elements, each with a position number and page name that reflects your site’s structure. For instance: Home > Personal Banking > Credit Cards > Rewards Cards.

Clear breadcrumbs make it easier for users to navigate between related services while helping search engines understand the relationships between your pages. This often leads to longer site visits and higher conversion rates.

Schema Summary Table

| Schema Type | Key Benefits | Implementation Priority |

|---|---|---|

| Organization | Boosts brand visibility and knowledge panel presence | High – Foundation for all other schemas |

| LocalBusiness | Improves local search and branch-specific visibility | High – Critical for physical locations |

| Product | Highlights services with rich snippets | Medium – Supports competitive differentiation |

| FAQPage | Simplifies user experience with direct answers | Medium – Reduces customer support workload |

| Breadcrumb | Enhances navigation and site structure understanding | Low – Improves user experience |

With these schemas in place, your website will not only be easier to navigate but also more visible and engaging in search results. Continue to the Schema Markup Implementation Checklist for detailed steps on setting everything up.

Schema Markup Implementation Checklist

Setting up schema markup for your banking website requires careful attention to detail to ensure your structured data is accurate, complete, and optimized for search engines.

Audit Website Content

Start by mapping out every page on your banking website. Create a spreadsheet that lists each page’s URL, its primary content type, and the most suitable schema markup. For instance:

- Homepage and branch pages: Use Organization and LocalBusiness schema.

- Service-specific pages: Pages like "Personal Checking Account" or "Home Mortgage Loans" should include Product schema.

Don’t overlook pages with FAQs, customer testimonials, or detailed service descriptions. These are ideal candidates for FAQPage and Review schema. Also, identify utility pages that might need specific markup.

Document the structure of your content, including how services are categorized and how branch locations are organized. This step ensures consistency in your schema implementation and helps search engines better understand your site. Once the content is mapped, move on to formatting the schema using JSON-LD.

Select and Format Schema Types

Using JSON-LD format is highly recommended for schema markup. It’s straightforward to manage and widely supported by search engines like Google and Bing.

Stick to the vocabulary provided by schema.org, as it’s the standard for structured data. For banks, focus on key schema types such as:

- Organization

- LocalBusiness

- Product

- FAQPage

- Breadcrumb

When dealing with related schemas, make sure to nest them properly. For example, connect individual branch LocalBusiness schemas to the main Organization schema using the parentOrganization property. This creates a clear hierarchy that search engines can easily interpret.

Fill Required and Recommended Fields

Ensure all fields are filled out using U.S. data formats. For example, use USD for currency, MM/DD/YYYY for dates, and 12-hour time formats.

- Organization schema: Include your bank’s legal name, official website URL, logo, headquarters address, and primary phone number. Use the

sameAsproperty to add links to your social media profiles (e.g., Facebook, Twitter, LinkedIn). - LocalBusiness schema: Provide complete branch details, including address, city, state, ZIP code, phone number, and operating hours for each day of the week.

- Product schema: Add detailed descriptions of your services, your bank’s brand name, and pricing information.

Validate Schema Markup

Before going live, test your schema markup thoroughly. Use these tools:

- Google’s Rich Results Test: Enter each page URL to check for errors, warnings, and to preview how your content will appear in search results. This tool highlights missing fields and formatting issues that could affect rich snippets.

- Schema Markup Validator: This tool goes beyond Google’s requirements, ensuring compliance with schema.org standards. It catches additional errors that might impact search engines other than Google.

Fix all critical errors before publishing. Minor warnings that don’t affect functionality can be addressed later. Make sure required fields are complete and formatted correctly for U.S. conventions.

Maintain and Update Markup

Regular maintenance is crucial. Review and update your schema monthly to reflect changes like updated branch hours, new services, or contact details.

When launching new services or modifying existing ones, update the Product schema immediately. For example, if you change interest rates, promotional offers, or fee schedules, your schema should reflect this information to avoid misleading users.

Use Google Search Console to monitor your schema’s performance. The "Enhancements" section shows which structured data types Google recognizes, along with any errors or warnings. Keep an eye on how your rich snippets perform in search results, and refine your strategy based on click-through rates and user engagement.

Finally, revisit your initial content audit regularly to ensure all updates align with your original schema mapping. This keeps your structured data consistent and effective over time.

Tools and Resources for Schema Markup

Setting up schema markup for your banking platform doesn’t have to be complicated. With the right tools, you can simplify schema creation, validation, and ongoing management. These resources complement the earlier implementation steps, ensuring your schema markup remains precise and effective.

Schema Validation Tools

Google’s Rich Results Test is an essential tool for checking the accuracy of your schema markup. It provides instant feedback on errors, warnings, and even gives you a preview of rich snippets for specific URLs or code snippets.

The Schema Markup Validator from Schema.org goes beyond Google’s requirements, validating your markup against the entire schema.org vocabulary. This ensures your structured data is compatible with other search engines and catches potential issues that might go unnoticed otherwise.

For creating schema, Schema Markup Generators are a great starting point. These tools let you input banking details into a form-based interface, which then generates JSON-LD code automatically. While they’re handy for straightforward implementations, more complex setups – like multi-location banking services – will need additional customization.

Google Search Console plays a critical role in monitoring your live schema. Its Enhancements section highlights performance metrics and flags any new schema errors, making it an invaluable tool for large-scale banking platforms.

CMS Plugins for Schema

If your banking platform uses WordPress, plugins like Yoast SEO can automate basic schema markup. Yoast covers essentials like homepages and contact pages without requiring manual coding. However, banking platforms often need advanced schema types – such as Product markup for financial services – which may require custom configurations.

RankMath offers more advanced schema options, including support for FAQ and Review schema types. This plugin allows you to add structured data directly within the page editor, making it easier for your content team to manage schema for new banking products or services.

For Drupal-based platforms, the Schema.org Metatag module integrates seamlessly with Metatag systems to enable structured data. If you’re using a custom CMS, you’ll likely need to implement JSON-LD directly. Many enterprise CMS solutions also offer modules or third-party integrations for schema management.

SearchX SEO Services

For banking platforms seeking expert support, SearchX provides specialized technical SEO services tailored to the financial sector. Their team understands the unique challenges banks face, from compliance requirements to representing complex service structures in schema markup.

Through their technical SEO audits, SearchX performs detailed schema analyses, identifying missing opportunities and fixing errors that could hurt your search visibility. For banks with multiple branches, they can implement and manage LocalBusiness schema across all branch pages while maintaining consistency with your Organization markup.

SearchX also offers ongoing schema maintenance, ensuring your markup stays updated as you launch new products, update services, or modify branch details. Their proactive approach keeps your structured data accurate and aligned with your SEO goals.

"Whether you’re looking for schema suggestions, keyword research, backlink analysis, or technical SEO analysis, Search Atlas has the features to maximize your site’s performance."

For banks that prefer to manage schema internally, SearchX provides training and consultation to equip your team with the skills needed to maintain and expand schema markup as your platform evolves.

Common Schema Markup Problems and Solutions

Banking platforms often face schema markup challenges that can block rich snippets from showing up in search results. After implementing schema, it’s crucial to be aware of these common issues to avoid disruptions. Recognizing these problems and addressing them effectively is key to maintaining strong search visibility for financial services.

Common Schema Markup Errors

One of the most frequent issues is missing required properties. For example, the Organization schema needs fields like name, url, and address, while the LocalBusiness schema requires telephone and openingHours. Without these core details, search engines may fail to interpret your markup correctly.

Another common problem is incorrect data formatting, especially for currency and date values. Currency should use three-letter ISO codes (e.g., USD), and dates must follow the ISO 8601 format (YYYY-MM-DD).

Using the wrong schema types or outdated properties can also cause trouble. For instance, applying Product schema to informational banking articles can confuse search engines about the content’s purpose. Additionally, properties that were valid in the past may now be deprecated, leading to validation errors.

Nested schema conflicts occur when schema types overlap without proper structure. For example, embedding Product schema within LocalBusiness schema without a clear hierarchy can create errors that prevent rich snippets from appearing.

Troubleshooting Checklist

- Start with Google’s Rich Results Test: This tool helps identify syntax errors, missing properties, and formatting problems. You can test your page URL or paste your JSON-LD code for instant feedback.

- Verify required properties with Schema.org: Ensure you include all mandatory fields. For example, Organization schema must have

nameandurl, while LocalBusiness requiresaddressandtelephone. If you’re using Product schema for banking services, include fields likename,description, andoffers. - Ensure formatting consistency: Use consistent formats for phone numbers, currency, and dates to avoid errors.

- Test schema blocks individually: When combining multiple schema types like Organization, LocalBusiness, and Product, validate each block separately to pinpoint issues.

- Monitor Google Search Console: Regularly check the Enhancements section for schema-related errors. Set up email alerts to stay informed about new problems.

- Use multiple validation tools: In addition to Google’s tool, try Schema.org’s validator for a more detailed analysis of your schema’s structure and relationships.

Addressing these issues promptly and making schema troubleshooting a regular part of your workflow can prevent disruptions and improve your site’s performance in search results.

Maintenance Tips

- Review schema monthly: Update details like service offerings, branch locations, and contact information regularly.

- Create a schema update process: Incorporate schema updates into your content workflow. For example, when launching new banking products or updating branch hours, revise your schema markup accordingly.

- Stay informed on updates: Follow Google’s Search Central blog and Schema.org announcements to stay ahead of changes that might affect schema requirements or rich snippets.

- Document schema usage: Keep a record of which pages use specific schema types and how they are connected. This documentation is invaluable for troubleshooting and onboarding new team members.

- Set up automated monitoring: Use tools that alert you to validation errors so you can resolve them quickly before they impact search visibility.

- Test in staging environments: Validate schema changes in a development setting before making them live. This helps catch errors early and ensures smooth deployment.

If schema issues persist despite following these steps, consider seeking professional technical SEO support. Companies like SearchX specialize in resolving technical SEO challenges, including schema-related problems, for complex platforms like banking websites. Their expertise can help ensure your site meets search engine standards for optimal performance and visibility.

Conclusion

Schema markup offers a powerful edge for online banking platforms. By implementing structured data correctly, financial institutions can boost their search visibility, improve user experience, and strengthen trust with both search engines and potential customers.

Banking websites often pose unique challenges due to their complexity – think multiple services, branch locations, and strict regulatory requirements. However, this checklist provides a straightforward path forward, highlighting key schema types like Organization, LocalBusiness, and Product to achieve meaningful results.

Key Takeaways

Start with the essentials. Focus on foundational schema types like Organization and LocalBusiness first. These schemas help search engines grasp your bank’s identity, locations, and core services, laying the groundwork for more advanced implementations.

Precision matters. Tools like Google’s Rich Results Test and Schema.org’s validator are invaluable for catching errors that could hurt search performance. Details such as currency formats, date structures, and contact information need to be exact – small mistakes can block rich snippets and undermine your efforts.

Consistency is key. Regularly reviewing and updating your schema ensures it evolves alongside your website. Monthly audits and a clear update process prevent common issues like outdated data, especially as new products or services are introduced.

These steps provide a solid foundation for effective schema deployment.

Next Steps

Now it’s time to put this plan into action. Begin by auditing your website to identify the most critical pages for schema markup. Start with high-impact areas like your homepage, key service pages, and branch location pages, as these typically yield the fastest improvements in search visibility.

If your platform requires a more comprehensive approach, professional assistance can make the process smoother. SearchX, a leader in technical SEO for financial websites, offers tailored solutions that align with both search engine requirements and banking industry regulations. Their expertise can help you implement schema markup efficiently while avoiding costly errors.

Investing in structured data is worth it. Done systematically, schema markup not only enhances your search visibility but also elevates user experience and strengthens your competitive position. By following these strategies, banking platforms can achieve measurable growth in their online presence and customer acquisition efforts.

FAQs

How does schema markup improve search visibility for online banking platforms?

Schema markup gives online banking platforms an edge in search results by organizing data in a way that search engines can easily process. This means banks can display rich snippets – like FAQs, branch locations, customer reviews, and details about financial products – directly within search results, making their listings more eye-catching and useful.

With schema markup, banks can highlight essential offerings such as loan options, credit card features, or interest rates. This not only boosts visibility in relevant searches but also builds user confidence and improves click-through rates by showcasing accurate, well-structured, and visually appealing information right on the search page.

What challenges do banks face with schema markup, and how can they overcome them?

Banks frequently face obstacles such as creating a well-defined strategy for schema markup and dealing with the technical challenges of implementation. These difficulties can result in mistakes or partial deployment, ultimately reducing the effectiveness of schema markup efforts.

To overcome these challenges, it’s crucial to stick to Google’s official guidelines and leverage tools that make schema markup creation and validation easier. Conducting thorough testing before deployment helps catch potential errors, and working with experienced professionals can simplify the process, ensuring all essential aspects are properly addressed.

Why is it essential to keep schema markup updated on a banking website?

Keeping the schema markup on a banking website up-to-date is crucial for ensuring that the structured data accurately represents the most current information. This makes it easier for search engines to interpret your site, which can boost its visibility and relevance in search results.

Frequent updates also ensure your site stays aligned with changing schema standards and best practices. For banking platforms, where precision and trust are essential, maintaining updated schema markup helps deliver reliable, relevant information to users, enhancing their experience and potentially driving more traffic.